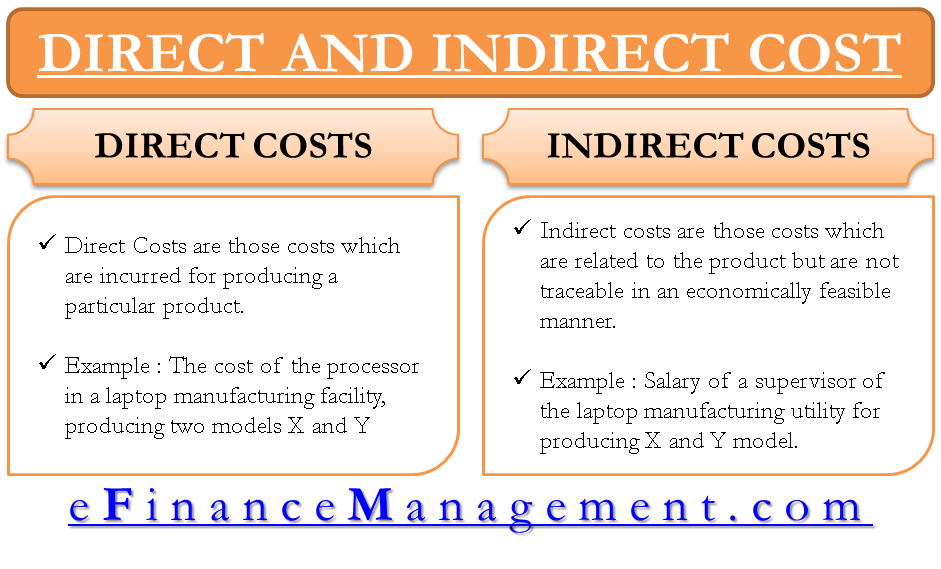

Indirect Cost is defined as the cost that cannot be allocated to a particular cost object. It is expended on specific cost object.

A cost that is easily attributable to a cost object is known as Direct Cost.

. Another example would be the cost of wheels and tires for a car manufacturer. We can categorise these costs into different categories such as direct and indirect costs. Examples of direct and indirect expenses Rent light salaries wages sales etc.

The difference between direct and indirect cost is that direct cost can be traced directly to a so-called cost objective such as a product or service for instance while indirect cost cannot be directly assigned to a particular cost objectiveThe individual definitions and example below will further explain the differences between direct and indirect costs. An Indirect cost is any cost that is not easily attributable to particular a project or service Kenton 2020. It is not easily calculated.

Examples raw material cost transportation cost etc. When all the direct costs are taken together they are known as prime costs. Explain the difference between direct and indirect costs.

Next I will discuss the indirect costs. It is not attributable has fixed cost and is difficult to identify. All indirect costs are.

Direct procurement is spending on services goods and materials that drive profit performance and competitive advantage. Finance questions and answers. Examples of direct costs include labour cost raw material cost transportation cost sales commission etc.

Whereas indirect procurement is expenditure on the maintenance goods and services needed for day-to-day operations which do not directly contribute to a companys bottom line. Explain and give examples of four types of quality costs. Acc307 32 1 professional labor hours indirect costs direct costs legal support indirect - cost pool cost -allocation base cost object.

Examples of Direct Costs and Indirect Costs. Indirect Costs Now the second cost is indirect costs. As an example we can say that direct costs are the expenses incurred for the raw materials used in the production process.

Direct Costs are any costs linked to a service product project organizational unit or activity. Difficulties in Cost Classification. They do not vary significantly with production volume and the majority are considered as fixed costs.

Explain the difference between product cost and period costs. Direct Cost Indirect Cost. An example would be the cost of lumber for a construction project.

Like direct costs indirect expenses can be either fixed eg rent or variable eg utilities. Examples of indirect costs include. Unlike direct costs you cannot assign indirect expenses to specific cost objects.

Examples of indirect costs include utility bills rent insurance on premises legal costs accounting expenses etc. On the other hand indirect costs are attributable to multiple products or services. The average direct costs depend on the nature of the injury or illness but usually ranges from 1000 to 20000.

Since one can directly attribute how much cost is expended per unit of raw material we call it direct cost. Explain how idle time overtime premium and fringe benefit costs are treated. A good round figure to use when estimating all lost time workplace injuries is 40000.

Examples of tax-deductible direct costs include repairs to your business equipment such. Some direct and indirect costs are tax-deductible. All direct costs are known as prime cost.

Direct Expenses Direct as the word suggests are those expenses which are completely related and assigned to the core business operations of a company. However indirect costs are fixed costs. It is the cost that is not easily referable to a particular serviceproduct.

This cost would remain the same even if more or fewer units are produced. Another difference is that direct purchases have a direct impact on the organisations operations whereas indirect purchases do not. Direct and indirect expenses are defined and differentiated as shown below.

The man difference between direct and indirect costs is that direct costs can be charged directly to a particular product service or unit. A direct fixed cost is a cost which is directly related to the production process or service delivery but does not vary as per activity level. A direct cost is though of as being affected by the number of units sold for example the cost of materials the more sandwhiches a cafe sells the more bread it will need to buy to fulfill these sales.

It is expended on multiple cost objects. 25 QUESTION 4 Explain the difference between direct costs of bankruptcy and indirect costs of financial distress For the toolbar press ALTF10 PC or ALTFNF10 Mac. Direct labor job for clients direct costs 2 2008 budgeted direct - cost rate per hour of professional labor 104000 1600 hours 65 per professional labor hour 3 2008 budgeted indirect - cost rate per.

Examples of direct costs are direct labor direct materials commissions piece rate wages and manufacturing supplies. In conclusion it has been shown that direct and indirect costs are different. What are differential opportunity and sunk costs.

Explain variable fixed and semi-variable costs. Direct costs are attributable to a specific product department goods or service. While in most cases direct costs are variables the indirect costs are fixed.

A direct fixed cost is the second type of direct costs the first being direct variable cost. Indirect purchases on the other hand are items that support manufacturing or resale and examples that might have been mentioned include marketing items IT facilities MRO supplies and stationery. Employee salaries eg administrative Professional expenses.

Of course the more accidents the higher the insurance. On the other hand advertisement expense is an indirect cost since it benefits the organization as a whole. Direct costs are variable costs that change based on the quantity of a product or service.

Examples of indirect costs are production supervision salaries quality control costs insurance and. The company pays insurance to cover these costs.

Direct Vs Indirect Costs Definition Differences Examples

Direct Vs Indirect Costs Directions Business Expense Cost

Different Between Indirect And Direct Costs Difference Between

0 Comments